Despite ‘Net Zero’ Rhetoric, Biggest Banks Continue to Pour Billions into Fossil Fuels

The world’s 60 largest financial institutions greenwash their oil addiction with claims they also fund renewable energy, have installed LED light bulbs in their branches and keep the thermostat low

April 4, 2022

One of the most comprehensive studies into banks funding fossil fuels has again found two corporate banks with large footprints in Rhode Island and Massachusetts among the top financial institutions propping up the continued burning of long-dead organic matter that is transforming the world’s delicate balance.

The Banking on Climate Chaos report, authored annually by a group of international environmental organizations such as the Sierra Club and the Indigenous Environmental Network, documents the vast amount of money the world’s biggest banks provide to the fossil fuel industry.

Two of the top four financiers of fossil fuel extraction are JPMorgan Chase (No. 1) and Bank of America (No. 4). They both have a significant presence in southern New England.

Since the planet is being increasingly destabilized and the well-being of most living things threatened by the persistent burning of oil, methane (natural gas), and coal, Climate Action Rhode Island believes the region’s residents should be informed that their money in these institutions is “being used to finance an industry that is causing the destruction of the world’s climate.”

Will Naksian, communications team leader for Climate Action Rhode Island, said the report shows the “funding of fossil fuel extraction is happening at a pace that is alarming.”

To protest the funding of this destructive partnership, the Cumberland resident, a member of the organization since 2018, noted people can withdraw their money from these banks or stay as a customer and make their unhappiness clear.

Naksian, a Bank of America customer, chose the latter and has sent several letters and emails and made phone calls expressing his concern with the bank’s ongoing practice of funding fossil fuel expansion.

“I believe I have more power as a customer to influence their financing practices,” he said. “Either way we have to keep the pressure on these institutions that continue to fund fossil fuels.”

On its website, Bank of America touts how it “achieved carbon neutrality, and how it seeks to amplify its efforts to achieve a net-zero global economy.”

“From the Paris Climate Agreement to the United Nations Sustainable Development Goals, the evidence is clear — when governments and nonprofit and private sectors work together, society is better positioned to achieve a healthier, sustainable environment and more resilient global economy,” according to the Charlotte, N.C.-based bank. “Bank of America has had a long-standing commitment to focus its business and operations to do its part, from investing in renewable energy projects to innovating how it can provide the capital needed to scale such projects globally.”

The JPMorgan Chase website claims the New York City-based bank “is committed to helping our clients navigate the challenges and capitalize on the long-term economic opportunities and environmental benefits of progressing toward a low-carbon world.”

The authors of the 2022 Banking on Climate Chaos, the 13th such report, note the stark disparity between public climate commitments being made by these mega financial institutions versus the reality of their largely business-as-usual financing of the fossil fuel industry.

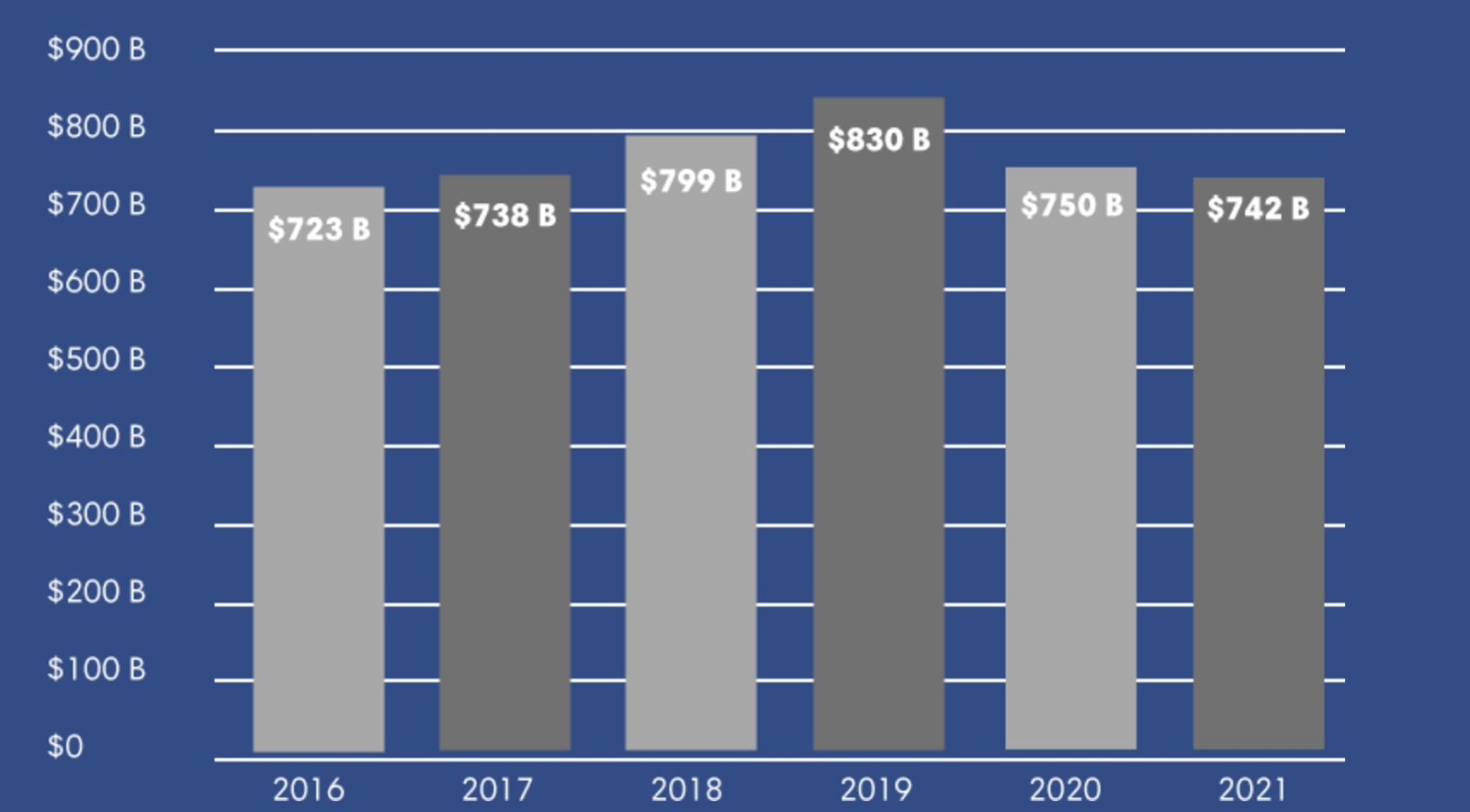

The report documents that in the six years since the Paris Agreement was adopted, the world’s 60 largest private banks financed fossil fuels to the tune of $4.6 trillion, including $742 billion last year.

Of particular significance is the revelation that the 60 banks profiled in the report funneled $185.5 billion last year into the 100 corporations doing the most to expand the fossil fuel industry.

The report shows that overall fossil fuel financing remains dominated by four U.S. banks, with JPMorgan Chase, Citi, Wells Fargo, and Bank of America together accounting for a quarter of all fossil fuel financing the past six years.

The 40-page report also includes a timeline that lays out how banks that joined the Net-Zero Banking Alliance (NZBA) last year simultaneously financed some of the most egregious oil and gas expansion companies, potentially helping to lock the planet into decades of climate-warming emissions.

In the months following the April 2021 launch of the NZBA, many signatory and soon-to-be-signatory banks engaged in huge transactions completely counter to achieving net zero: $12.5 billion to QatarEnergy (Citi, JPMorgan Chase, Bank of America, Goldman Sachs); $10 billion to ExxonMobil (Citi, JPMorgan Chase, Bank of America, Morgan Stanley); $10 billion to Saudi Aramco (Citi, JPMorgan Chase).

Out of the 44 banks in thes report currently committed to net-zero financed emissions by 2050, 27 still don’t have a meaningful no-expansion policy for any part of the fossil fuel industry.

The world’s leading climate scientists have concluded that existing reserves of fossil fuels contain more than enough carbon pollution to break the planet’s remaining “carbon budget” and thrust the world past 2 degrees Celsius of warming — let alone the 1.5-degree aspirations of the Paris Agreement.

A recent report from the United Nations — the third released by the Intergovernmental Panel on Climate Change in the past eight months (the first two can be found here and here) — is less about how bad the situation will get and more about how poorly humankind is addressing this climate emergency.

To avert the worst consequences of the climate crisis, the analysis released April 4 notes world leaders must make radical and immediate changes, including the rapid phasing out of fossil fuels.

In the press release that announced the recent report, U.N. Secretary-General Antonio Guterres said the report revealed “a litany of broken climate promises” by governments and corporations.

“It is a file of shame, cataloguing the empty pledges that put us firmly on track toward an unlivable world,” he said.

This petroleum-paved track is being laid by a small contingent of powerful and wealthy banks and fossil fuel corporations.

The new Global Oil & Gas Exit List exposes the fact that upstream oil and gas expansion is remarkably concentrated. To wit:

The top 20 fossil fuel companies are responsible for more than half of the industry’s development and exploration.

The top 10 banks of those 20 companies are responsible for 63% of the industry’s big-bank financing since the Paris Agreement was signed Dec. 12, 2015.

Even more alarmingly when it comes to the planet’s climate future, the financing of heavy-polluting tar-sands mining saw a 51% increase in financing from 2020 to 2021, to $23.3 billion. Hydraulic fracturing (fracking) saw $62.1 billion in financing last year, and JPMorgan Chase was among the top banks funding Arctic oil and gas exploration last year, with a total of $8.2 billion in funding.

These 60 banks to continue to fund companies planning to open up new fossil fuel frontiers, including by financing projects such as the East African Crude Oil Pipeline, expansion of fracking in Argentina’s Vaca Muerta, and the expansion of the Trans Mountain tar sands pipeline.

“Any further expansion of fossil fuels risks locking humanity into generations of climate catastrophe, yet the top fossil clients of the world’s largest banks are still being showered with tens of billions of dollars even as they actively expand drilling, mining, fracking and other fossil fuel development unabated,” said Alison Kirsch, research and policy manager for the Rainforest Action Network.

Categories

Join the Discussion

View CommentsRecent Comments

Leave a Reply

Your support keeps our reporters on the environmental beat.

Reader support is at the core of our nonprofit news model. Together, we can keep the environment in the headlines.

We use cookies to improve your experience and deliver personalized content. View Cookie Settings

I’m glad to have this disheartening information but hope that there are larger group actions against these banks that might eventually have an impact. My credit cards both are connected with JP Morgan but I doubt “working from within” alone will have a impact on corporate decisions. Does the graph suggest Morgan Stanley is acceptable to work with, or just less bad?

Since you have Credit cards with Chase, I recommend you do what I did and sign up for the CustomersForClimateJustice.com campaign and the related StoptheMoneyPipeline.com campaign. Over 35,000 customers of the four top fossil fuel banks have signed up, over 13,000 of whom are Chase customers, and the campaigns are using their group strength to pressure the banks. DON’T drop your card or account with Chase, Bank of America, Wells Fargo, or Citibank yet because we may use the threat of large-scale departures from these banks all at the same time as leverage to get more action on climate from them.