Our Tax Structure Punishes Environment, Public Health and Low-Wealth Families

Consider: Rhode Island taxes bicycles, skateboards but not yachts, powerboats

September 7, 2023

Taxes are vital to democracy, but it is time we start spreading the burden justly. State and federal government needs to stop shaking down low-wealth families and blue-collar workers, unless they are buying a gas-guzzling vehicle or a backpack that blows leaves around.

For all the attention the income tax receives, the tax burden for most Americans comes primarily from payroll taxes, not income taxes, according to a 2019 report by the Joint Committee on Taxation.

Americans with less than five-figure incomes pay an effective payroll tax rate of 14.1%, while those making seven-figure incomes or more pay just 1.9%, according to the Center for American Progress.

Most states make their low-wealth residents contribute a greater share of their income to taxes than their wealthy ones. Nationwide, the share the lowest-income earners pay to state and local taxes is 54% higher than what the top earners pay, according to the Institute on Taxation and Economic Policy.

It’s time we get creative, and fairer — for human and environmental health and humankind’s future — when deciding how and what we tax. We need to switch the tax onus away from things that don’t pollute and waste resources to things that do.

We can start by taxing the utterly useless so heavily that we no longer make plastic shower curtains with pockets for electronic devices so we can read emails and text messages in the shower; miniature leaf blowers designed as mini-dust blowers, to keep keyboards and computer areas clean; dog selfie sticks; plastic cups to hold hamburgers; perfume that smells like dirt; and K-Cups.

Most of this hogwash is made of polluting plastic. We’re extracting, transporting, and burning fossil fuels to manufacture rubbish. We’re devouring the planet for cheap laughs and frivolous convenience.

We should provide a tax break for those who don’t own a vehicle. Also, stop taxing bicycles, skateboards, in-line skates, and walking shoes.

Tax heavy polluting transportation choices at a far higher rate. For example, jack up the sales and excise taxes on petroleum-gulping sport-utility vehicles, Hummers, and supersized pickups — even those powered by battery, as they devour resources and make our roads unsafe. Do the same for private jets, yachts, powerboats, snowmobiles, Jet Skis, and all-terrain vehicles.

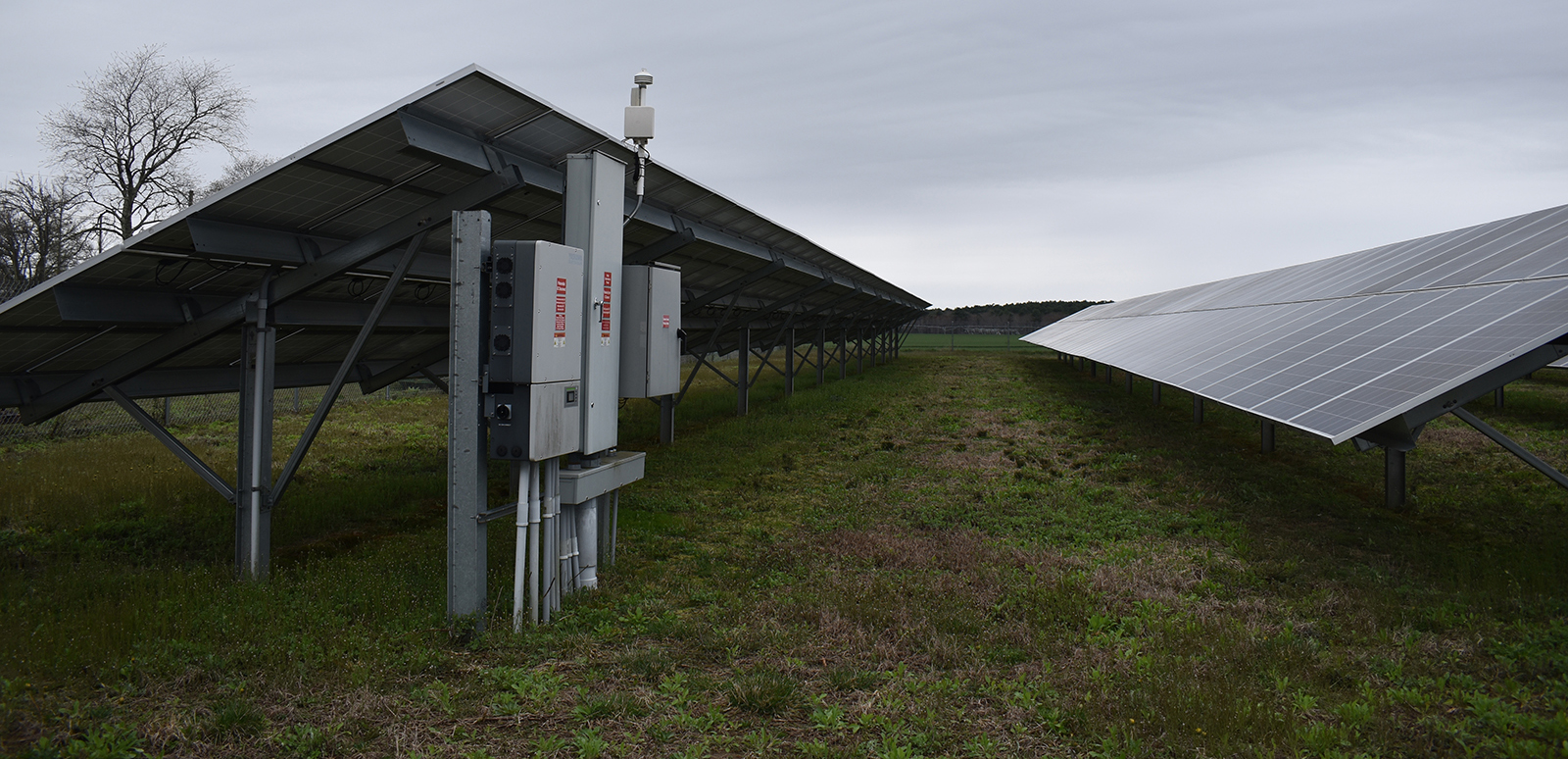

Sadly, higher taxes likely won’t impact the sale of these carbon-spewing machines, as we seem to love to pollute despite the severe (and known) costs, but it could raise money for underfunded climate change and public health initiatives. It could also fund heat pump rebates and rooftop solar incentives.

For example, sales of SUVs, which are responsible for a huge chunk of climate emissions, have soared worldwide in the past decade, even as mounting evidence of the climate crisis routinely smacks us in the face. Sales have risen from 20% of new vehicles in 2012 to 46% of all vehicles last year, with noticeable growth coming in the United States, according to the International Energy Agency.

Despite a “strong increase in sales of electric models,” it wasn’t enough to prevent carbon dioxide emissions from SUVs worldwide reaching almost 1 billion tons in 2022, according to the agency. To put it another way, if SUVs were a country, they would be the world’s sixth-biggest carbon polluter.

If we had a fair and functioning democracy, for instance, elected officials would impose a hefty tax on private jet owners and passengers (better yet, ban them; the jets, not the people), but instead, the cost of a private jet can be used as a tax deduction. Teachers can write off only $300 for classroom supplies, but CEOs can write off the full cost of their jets. Show me in our ridiculously skewed tax code where mere common folk enjoy a similar tax break as those offered to jet and yacht owners.

In Rhode Island, the state’s no-sales-tax policy on boats, including yachts, went into effect in 1993, thanks in large part to the lobbying efforts of the Rhode Island Marine Trades Association. Good policy for canoes and kayaks, but shortsighted for powerboats and yachts. There also is no boat excise tax in Rhode Island.

A 2019 blog post on a Newport-based yacht seller notes “you don’t have to live in Rhode Island to take advantage of these exemptions. According to the most recent statistics, approximately half of the registered boaters in Rhode Island live in other states.”

The super wealthy always win, even when it fuels the climate crisis and diminishes public health.

Speaking of the ultra-rich, heavily tax space tourists and those who provide the unnecessary indulgence. Better yet, ban for-profit rocket rides.

In fact, taxes on all fuel, including jet and rocket, need to be higher. The federal tax on gasoline, which funds transportation infrastructure maintenance and repair, is 18.4 cents a gallon and 24.4 cents a gallon for diesel. The rate of the federal gasoline tax has been increased 10 times since 1933, when it was $0.01 a gallon, but it has not been touched since 1993, when it went from 14.1 cents to its current rate.

The average state tax on gasoline and diesel is 31.6 cents and 33.8 cents, respectively.

But instead of raising taxes on these fossil fuels, even as wildfires spread, floodwaters rise, and droughts intensify, oblivious elected officials would rather score political points.

In Connecticut, a scheduled increase in the state’s tax on diesel fuel didn’t go into effect this year — the result of a little-discussed provision in the state budget that halted the annual adjustment of the tax.

Connecticut’s diesel tax is set through the combination of two elements: a flat, 29-cent rate and a variable rate calculated based on the previous year’s wholesale cost of diesel. Last year’s annual adjustment caused the diesel tax to increase from 40.1 cents a gallon to its current 49.2.

Lawmakers then sang a familiar tone-deaf tune. They estimated the waived adjustment would save Connecticut consumers more than $37 million, according to a story in CT News Junkie.

“I’m pleased that the budget cancels a planned increase in the diesel fuel tax that had been scheduled to go into effect,” Senate President Martin Looney is quoted. “We are constantly trying to improve Connecticut’s business climate, and make us more competitive, whenever possible.”

No mention was made of trying to mitigate the climate crisis

Last year in Rhode Island, with gasoline prices on the rise, some lawmakers called for the suspension of the state’s gas tax. Rhode Island taxes gasoline and diesel at 34 cents a gallon. The Rhode Island Public Transit Authority is funded in large part by revenue generated by the state’s gas tax. The tax also helps fund the transportation infrastructure, including the filling of potholes, on which motorists rely.

The best solution to high gas prices is not to increase demand for gasoline by making driving cheaper, but to encourage alternatives to gasoline consumption by promoting, supporting, and funding public transit and pedestrian and bicycling infrastructure.

Improving, not gutting, public transit and making walking and biking safer and easier would also help mitigate the climate crisis.

But when it comes to transit choices that would benefit low-income and non-car-owning (and non-yacht- and non-jet-owning) populations, the political appetite for action vanishes. The desire to keep the wealthy and powerful happy — so they donate to campaign coffers, host lavish fundraisers at walled-off estates, or put in a good word for your reelection — routinely supersedes public health, climate change mitigation, and the widening inequality gap.

Rhode Island lawmakers for the most part are against proposals looking to make riding RIPTA free. Last year an amendment to Rhode Island law to exempt bicycles from the state sales tax was held for further study. Sales tax on bicycles and skateboards but not yachts and powerboats says it all.

The spewing of climate-changing emissions isn’t limited to machines that churn up waterways, rumble over pavement, or speed through the air. We also burn a ridiculous amount of polluting fossil fuels mowing an estimated 40 million to 50 million acres of lawn in the continental United States — nearly as much as all of the country’s national parks combined.

Three billion gallons of gasoline was consumed in 2020 to maintain this monolithic landscape — the equivalent of adding some 6 million cars to our roadways.

The sales tax on air- and noise-polluting lawn-care equipment, most notably leaf blowers, also needs to be raised. Better yet, ban the use of leaf blowers.

Frank Carini can be reached at [email protected]. His opinions don’t reflect those of ecoRI News.

If only!!! I agree with everything Frank says!

Amen

great column. It seems we live under that golden rule (those with gold rule) even in Democratic states which is one reason why so many who knw what is going on have given up on politics and don’t bother to vote.

Just to quantify one point: To exempt the first $4000 of motor vehicle value from local property tax the state spent about $100 million/year. Recently that was increased to over $230 million to exempt the full value of every car/SUV, a huge increase in the state budget of zero benefit to those with no car or just an old car, but a huge benefit for households with the most cars (thus contributing the most to congestion) and/or luxury cars, eliminating one of the few taxes on wealth. That the environment and social justice community did not protest that seems shameful

Agreed, Frank hit all the buttons and we all can ad our pet gripes; mine has to do with RIPTA buses. I see huge buses, spewing emissions, motoring along with sometimes one customer. Question, when have these buses EVER been full? Solution, get smaller buses and vans for these runs.

Joanna

I agree with you, Frank. Why not stop School Departments from paying private bus companies and contribute those funds to RIPTA? Now, students who miss the school bus, contribute to the high rate of absenteeism. If the public bus ran a loop, those children could catch the next bus and get to school, late, but not miss the whole day of learning. Last I checked, Newport’s school expenditures are tied for the second highest costs between heating and bussing.

Thanks for telling it like it is, Frank.