Burrillville Town Council Opposes Power Plant Tax Bill

June 8, 2016

BURRILLVILLE, R.I. — The Town Council is going against a groundswell of local opposition to the proposed natural gas power plant by opposing legislation that would allow residents to vote on a key aspect of the project.

The bill was passed by the House of Representatives on June 7. The Senate version (S3037) was scheduled for a hearing June 8. Both bills would allow residents to vote on a tax agreement that is negotiated between the town and the owner of the power project. The tax treaty is an important negotiating point in the overall economic viability of the $700 million project. Such an agreement typically offers guaranteed tax payments to the host community, but below the standard property tax rates that would be assessed to an industrial property.

In a statement, the Town Council wrote the tax treaty is the only leverage the town has with Invenergy, the Chicago-based developer and would-be owner of the power plant. For the most part, the proposal is approved or denied by the state Energy Facility Siting Board (EFSB). The EFSB is given such power to assure that power plants get built. Otherwise, as the reasoning goes, the not-in-my-backyard (NIMBYism) prevails, as local residents are prone to aggressively fight proposed energy facilities.

“The one area where the Town Council does have power is in negotiating a tax treaty. The purpose of the agreement is to properly compensate Burrillville residents should the EFSB approve the plant,” according to an unsigned and undated letter from the town clerk.

The letter noted that a tax deal has yet to be reached, but so far a preliminary agreement gives the town $2.9 million upfront, plus $1.2 million even if the EFSB denies the application. Guaranteed payments would amount to between $92 million to $180 million over 20 years. There also are unnamed financial protections for property owners living near the proposed power plant. Lastly, a tax treaty would include a plan to fund the decommissioning of the nearly 1,000-megawatt natural gas facility.

The letter also states that the Town Council is taking a neutral stance on the project so it will not taint the legitimacy of advisory opinions from the Zoning Board and Planning Board, the tax assessor and building official to the EFSB.

The Town Council wasn’t consulted in the crafting of the legislation by Rep. Cale Keable, D-Burrillville, and Sen. Paul Fogarty, D-Burrillville. If passed, the bill would prohibit the town from preventing court challenges and litigation that may arise over tax issues related to the power plant. Legal issues with the Ocean State Power plant has cost the town hundreds of thousands of dollars in legal fees, according to the letter.

“The legislation will not stop the proposed power plant from locating in Burrillville, or even require the power plant to consider residents’ wishes,” according to the letter.

The fate of both bills is unclear. Gov. Gina Raimondo supports the power plant and may veto should one of the bills pass the House and Senate. The General Assembly has enough votes to override a veto but may run out of time to do so, as the legislative session is expected to finish for the year by the end of June. House Speaker Nicolas Mattiello, D-Cranston, appears to favor the bill; Senate President Teresa Paiva Weed, D-Newport, is uncommitted.

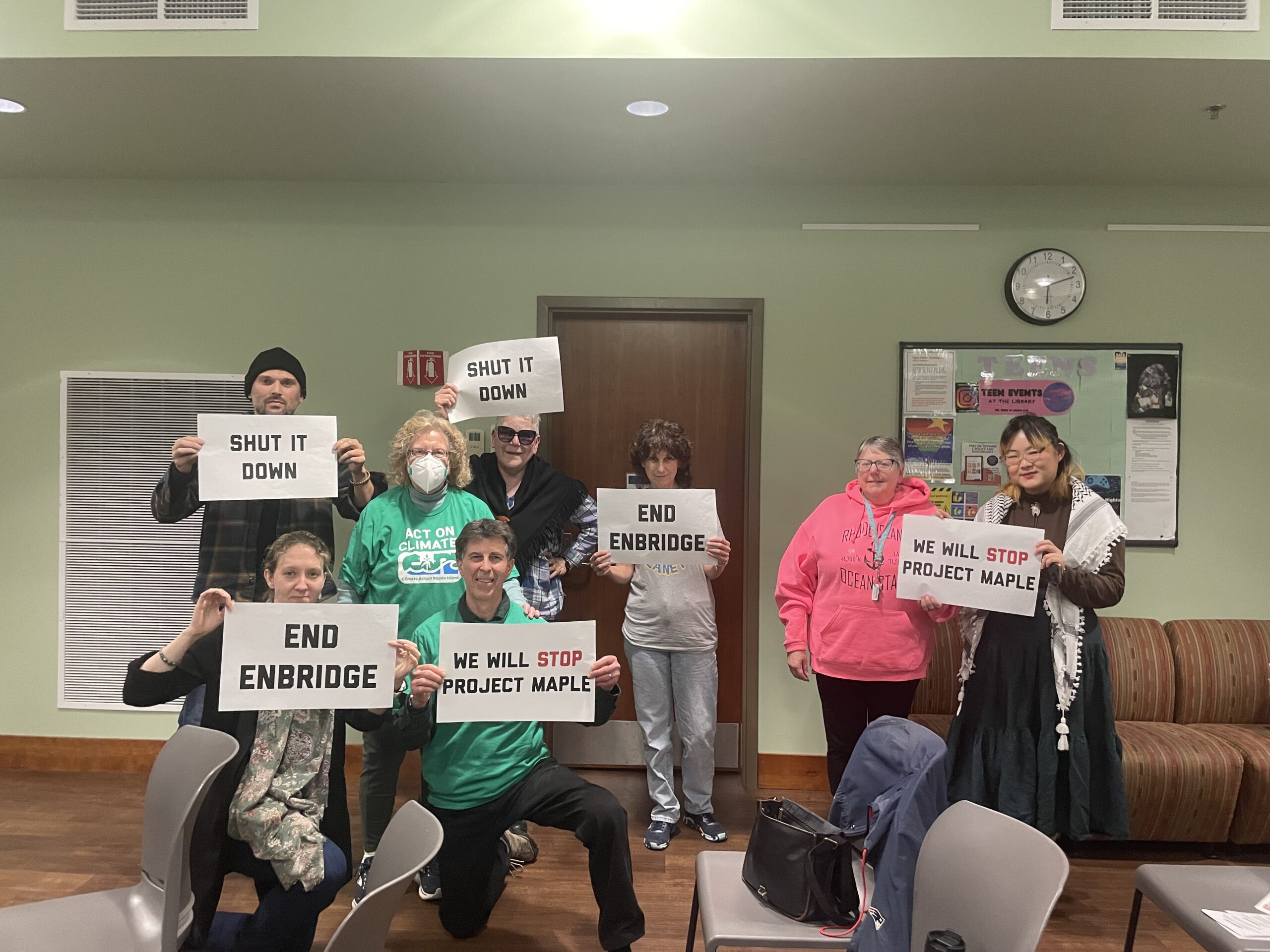

Opponents of the power plant have dominated public listening sessions hosted by the EFSB and a May 23 hearing for the House bill.

Categories

Join the Discussion

View CommentsRelated Stories

Your support keeps our reporters on the environmental beat.

Reader support is at the core of our nonprofit news model. Together, we can keep the environment in the headlines.

We use cookies to improve your experience and deliver personalized content. View Cookie Settings